Several Acts have been established with the aim of identifying, reporting and prosecuting criminal activities relating to money laundering and terrorist financing in South Africa. However, keeping up with the ever-changing anti-money laundering concepts, acronyms and the Acts can be challenging.

Here are just a few examples:

The Prevention of Organised Crime Act (POCA): The POCA introduced laws that work against organised crime and gang activities, with a special focus on money laundering, racketeering and related illegal business activities.

Anti-Money Laundering (AML): Refers to the fight against money laundering and can include many processes and steps that get taken to attempt to prevent money laundering from occurring.

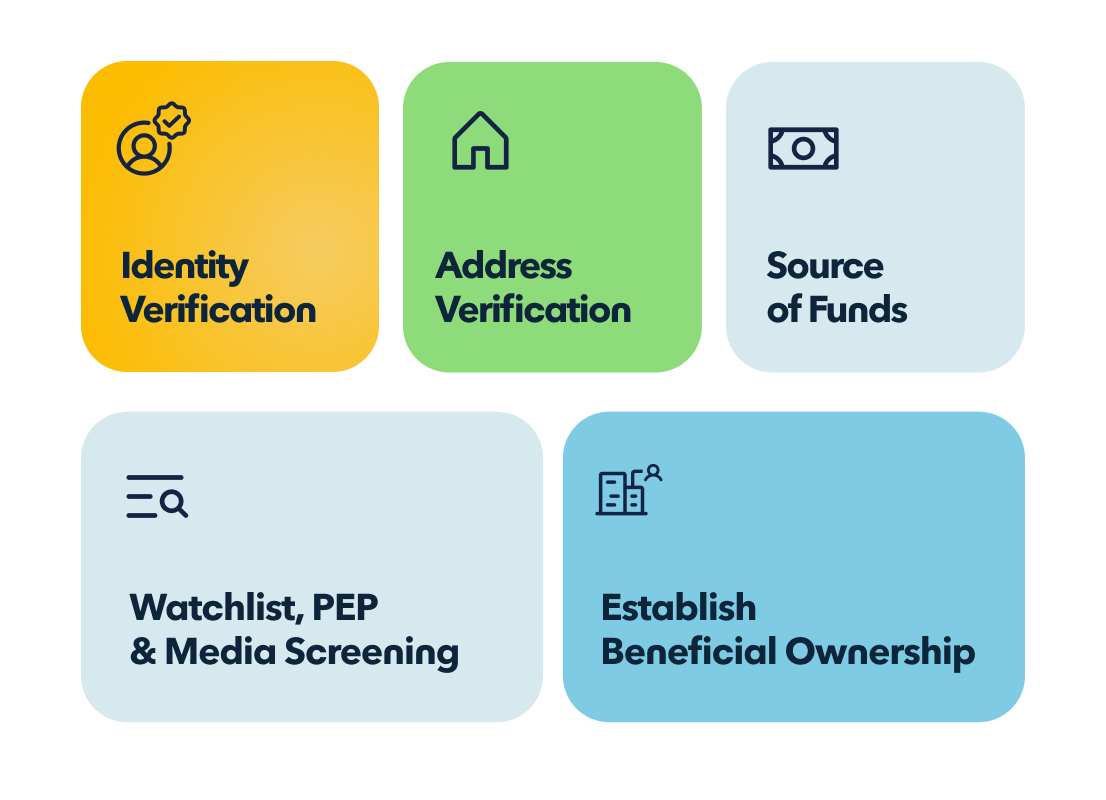

Know Your Customer (KYC): The practice carried out by institutions to identify and verify who their clients are before stepping into a business relationship. For individuals, this proof is often presented by means of an ID book and proof of residence.

We have put together a reference guide to simplify and provide you with a broad understanding, and quick reference, of these Acts, concepts and acronyms. Download your free copy below!

About the author:

Hawken McEwan

Hawken has over 25 years' experience in financial crime compliance, regulatory operations, banking operations, risk and change. Specialising in FICA and Anti-Money Laundering, Hawken is an FSCA approved Compliance Officer, FAIS Key Individual and an advisor to BankSETA around AML due diligence and transaction monitoring. He holds a Masters from the University of Edinburgh, a PGCE from the University of Sunderland and is a certified Anti-Money Laundering Specialist.