As a High-Value Goods Dealer (HVGD), do you have questions about the Financial Intelligence Centre Act (FICA) and the requirements you have to meet? We’ve compiled a FICA FAQ guide to answer your most pressing questions.

The Financial Intelligence Centre states that if you sell a single physical item for R100,000.00 or more, you are classified as an Accountable Institution and need to fully comply with the requirements of the FICA.

The FICA regulation aims to combat financial crime and ensure that large transactions are legitimate and not part of illegal activities. If you're a manufacturer and/or seller of high-value goods—such as machinery, vehicles, heavy equipment, or medical equipment you might be wondering what exactly does this mean for your business?

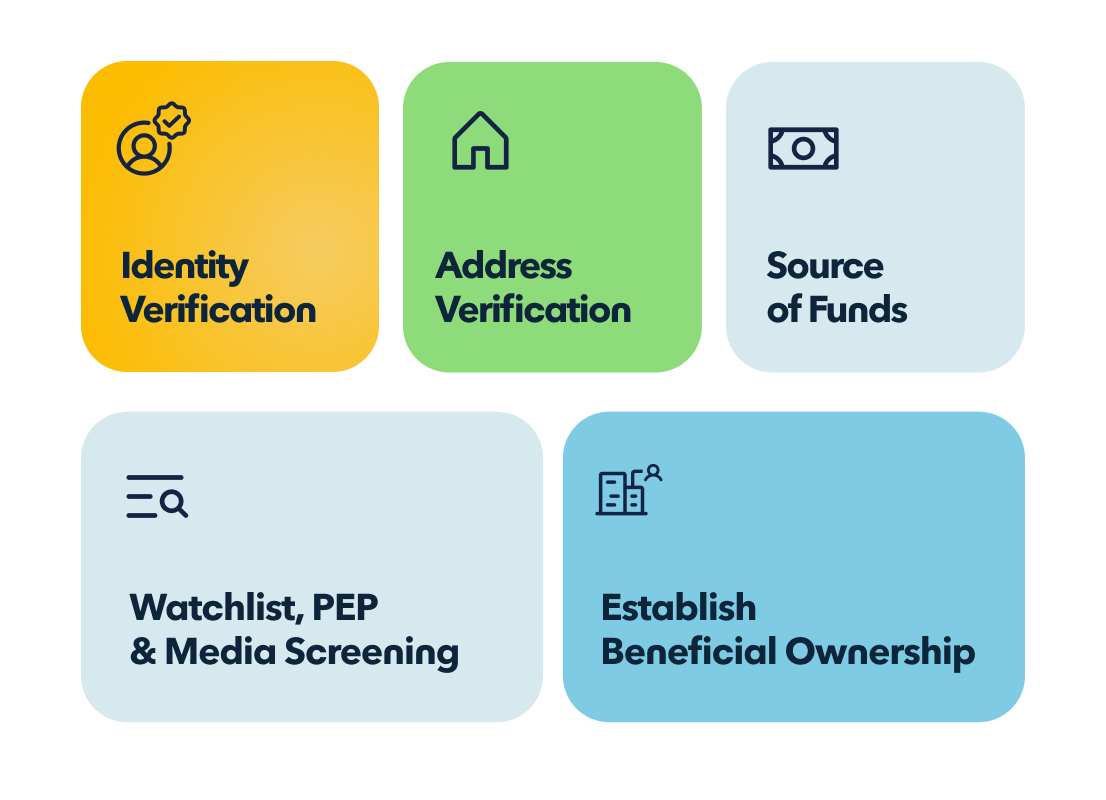

Whether you are unsure if your business is classified as a HVGD, need to understand your FICA compliance obligations, or how to perform Customer Due Diligence, our guide is here to assist you.

The guide addresses common concerns, such as:

- Who is defined as a HVGD?

- My business has been operating for years without needing to comply with FICA. What has changed?

- Can we outsource FICA requirements, such as Customer Due Diligence (CDD) to someone else?

- If banks perform FICA checks, do we still have to do it?

Download a copy today to ensure your business meets all the FICA compliance requirements.

About the author:

Hawken McEwan

Hawken has over 25 years' experience in financial crime compliance, regulatory operations, banking operations, risk and change. Specialising in FICA and Anti-Money Laundering, Hawken is an FSCA approved Compliance Officer, FAIS Key Individual and an advisor to BankSETA around AML due diligence and transaction monitoring. He holds a Masters from the University of Edinburgh, a PGCE from the University of Sunderland and is a certified Anti-Money Laundering Specialist.