The Financial Intelligence Centre Act (FICA) was introduced to fight financial crime, such as money laundering, tax evasion, and terrorist financing activities by making it more difficult for criminals to benefit from the proceeds of crime.

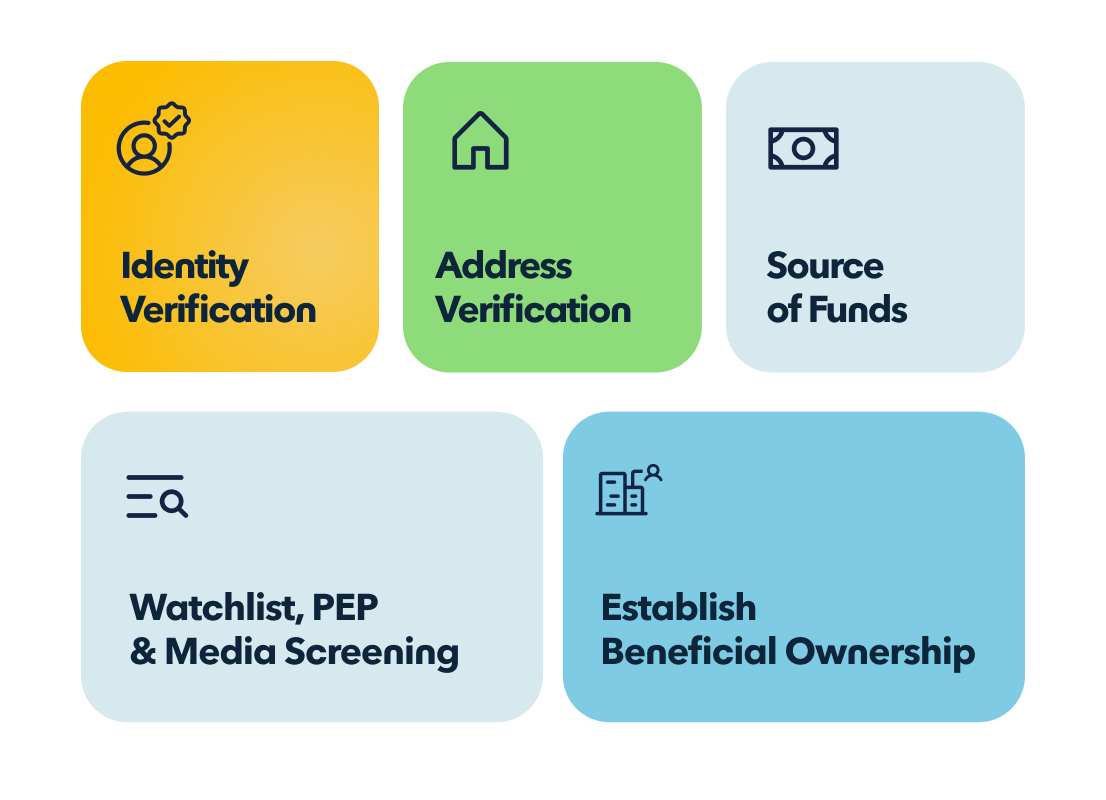

The Key Obligations in Terms of FICA Include:

To achieve this, the Financial Intelligence Centre (FIC) requires Accountable Institutions to fulfil various FICA obligations, such as:

-

To establish and verify the identity of clients.

-

To understand the nature and purpose of a transaction/relationship.

-

To keep records of business relationships and transactions.

-

To screen against sanctions watchlists.

-

To report receipts of cash above a prescribed amount to the FIC.

-

To report suspicious transactions or activities to the FIC.

-

To document internal processes consistent with obligations under FICA.

-

To offer compulsory FICA training to all employees.

-

To appoint a compliance officer.

-

To identify the source of funds for transactions.

We created a handy guide that unpacks these obligations and summarises the FIC Amendment Act. Click the button below to get your copy.

About the author:

Hawken McEwan

Hawken has over 25 years' experience in financial crime compliance, regulatory operations, banking operations, risk and change. Specialising in FICA and Anti-Money Laundering, Hawken is an FSCA approved Compliance Officer, FAIS Key Individual and an advisor to BankSETA around AML due diligence and transaction monitoring. He holds a Masters from the University of Edinburgh, a PGCE from the University of Sunderland and is a certified Anti-Money Laundering Specialist.