There isn’t a parent in the world who hasn’t faced the relentless force of "pester power". It usually starts with a frantic explanation of why a specific "skin," weapon, or character in a video game is a matter of social life or death. For most parents, capitulating and spending a few hundred Rands on Fortnite V-Bucks or Roblox Robux is a small price to pay for peace.

But behind these innocent microtransactions lies a parallel economy processing billions of transactions a year – and where there is high-volume, unregulated money movement, financial criminals are never far behind.

While South African banks and financial institutions have spent the last few years hardening their defences against money laundering (driven by the pressure of the country's greylisting until October this year), online gaming platforms remain a digital Wild West. They process value like a financial system but often lack the regulatory checks of one.

For criminals, this is a perfect storm. And increasingly, they are recruiting children to do their dirty work.

The digital wash cycle

To understand the risk, one must look at how gaming economies mirror the traditional stages of money laundering: placement, layering, and integration.

"Most popular, multiplayer games today you don’t just buy and then play, with that being said," explains Hawken McEwan, Director of Risk & Compliance at nCino KYC Africa. "Players are encouraged to 'level up' by buying coins or ever rarer items constantly being released to win the game of one-upmanship among their peers. This ecosystem has become a perfect hiding spot for money launderers."

The scale of the so-called “microtransaction” market is staggering, currently valued at around $85 billion. It’s not niche. It’s not something ‘only a few kids’ could come across.

The laundering process is simple yet effective:

-

Placement: Criminals use stolen credit card details to bulk-buy in-game currency or high-value items. To the gaming platform, this looks like thousands of legitimate R500 purchases, for instance.

-

Layering: They convert these currencies into virtual assets – rare skins, limited-edition weapons, or virtual real estate. These items hold significant real-world value because other players covet them.

-

Integration: The criminals sell these assets on third-party marketplaces or in-game trading posts to unsuspecting legitimate players.

To anyone outside, the money trail now shows a 'gamer' who sold virtual items and received payment – a completely legitimate-looking transaction. The original crime of credit card theft is now several steps away and invisible.

The "easy money" trap on Discord

The most alarming aspect for parents is not just the illicit flow of funds, but the active recruitment of minors that also happens. Sophisticated syndicates know that children are less likely to spot a scam and even less likely to report it to an adult for fear of losing their gaming privileges.

Recruiters prowl gaming forums and Discord servers, targeting young players with offers that sound like a dream come true for a 14-year-old: "I'll pay you R500 if you accept some items from me and sell them to other players. You keep a commission."

To a teenager, this sounds like easy pocket money for doing something they already enjoy. They don't realise they are the final step in a laundering operation, converting criminal proceeds into clean money through their legitimate gaming account.

Because the gaming world is borderless, a South African child’s account could be used to "clean" funds from a credit card stolen in the UK, to buy items sold to a player in the US. This jurisdictional complexity makes it incredibly difficult for law enforcement to track.

A regulatory blind spot

Why are criminals now targeting games instead of just sticking to traditional crypto exchanges or banks? The answer lies in the red tape – or lack thereof.

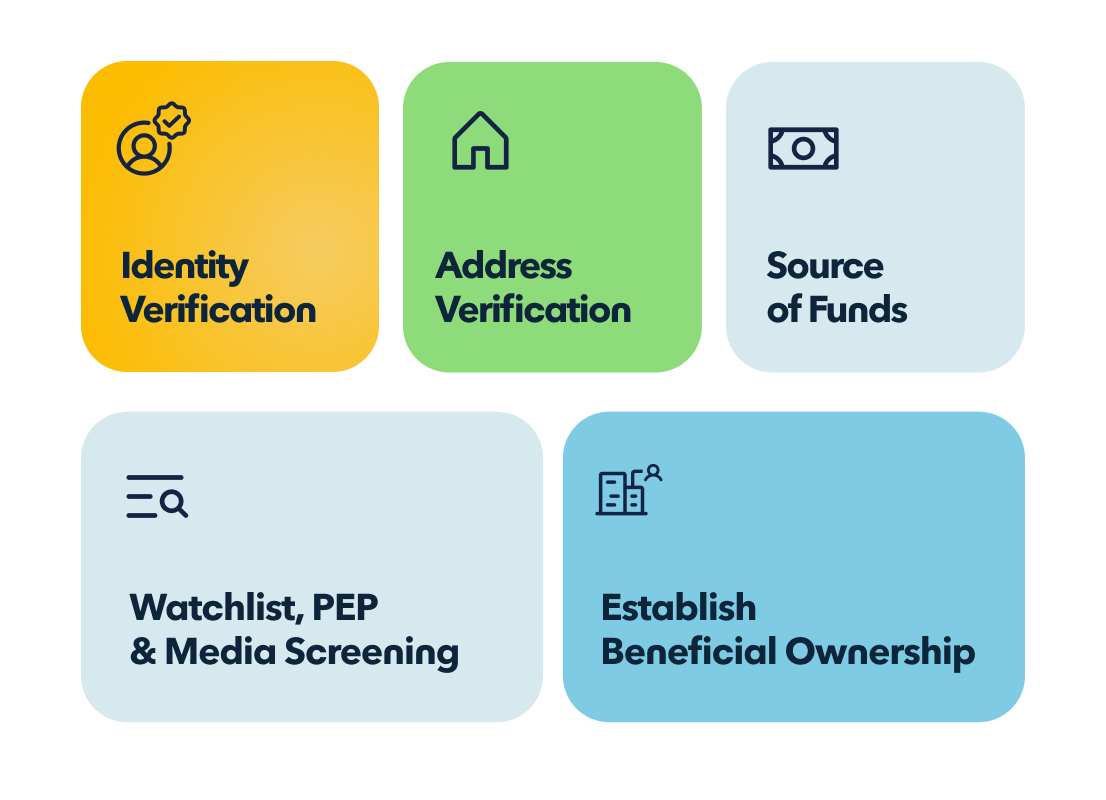

Despite processing massive financial flows, most gaming platforms are not yet classified as accountable institutions under the Financial Intelligence Centre Act (FICA) or similar international laws. They are not required to perform the rigorous Customer Due Diligence (CDD) or suspicious activity reporting that a bank or a crypto exchange must adhere to.

"Implementing robust anti-money laundering controls is expensive and complex," says McEwan. "While some larger platforms are introducing voluntary measures to protect their reputation, there is currently no legal obligation for them to do so in the same way banks must. This makes them an attractive, low-resistance channel for criminal exploitation."

The real-world cost of virtual crime

For parents, the risks of a child becoming a "money mule" extend further than coming down to a slap on the wrist. In South Africa, facilitating the movement of proceeds of crime is a serious offence under money laundering legislation.

While prosecutors might show leniency to a manipulated minor, the financial consequences can be severe. Banks are increasingly vigilant; if a child's bank account (or a parent's account linked to the game) is flagged for receiving stolen funds, the bank may freeze the funds or close the account entirely to manage their own risk.

"Beyond the practical consequences, discovering they have been manipulated by criminals is genuinely scary for a child," adds McEwan. "The guilt, fear, and breach of trust can have lasting impacts."

What should parents do?

Vigilance does not mean banning video games, but it does require a new kind of "digital street smarts."

-

Follow the money: Watch out for sudden influxes of cash or in-game currency that cannot be explained by chores or allowances.

-

Have the talk: Have explicit conversations about the value of digital items. Explain that if a stranger offers free items or a "commission" for moving goods, it is likely a trap.

-

Create safety, not fear: Ensure children understand that if they have already engaged in something suspicious, they can come to you without fear of punishment. The priority is stopping the activity and mitigating the damage, not discipline.

As financial crime evolves, it invariably seeks the path of least resistance. Right now, that path runs directly through the virtual worlds our children inhabit.

Inside Roblox's Criminal Underworld, Where Kids Are Scamming Kids

If you haven't already, sign up to our Newsletter to keep updated with the latest in Anti-Money Laundering news.

About the author:

Hawken McEwan

Hawken has over 25 years' experience in financial crime compliance, regulatory operations, banking operations, risk and change. Specialising in FICA and Anti-Money Laundering, Hawken is an FSCA approved Compliance Officer, FAIS Key Individual and an advisor to BankSETA around AML due diligence and transaction monitoring. He holds a Masters from the University of Edinburgh, a PGCE from the University of Sunderland and is a certified Anti-Money Laundering Specialist.