In a world where financial crime is increasingly complex and digital, the first step you take with a client matters more than ever. Onboarding can be either your strongest line of defence, or your greatest weakness.

Today, fraud doesn’t always arrive wearing a mask. It can walk straight through your front door, in the form of a shell company, a stolen identity, or a politically exposed person buried in layers of ownership. During the client onboarding process, institutions face an inherent risk of internal fraud, cyber-enabled scams, and manipulation of transactional systems. With the Southern African Fraud Prevention Service (SAFPS) noting that active fraud listings increased by 26% year-on-year in 2024 alone, there is a growing concern that weak onboarding processes could be providing entry points for financial crime.

As accountable institutions under the Financial Intelligence Centre Act (FICA), you sit at the crossroads of regulatory risk, fraud risk and reputational risk. And with the FIC tightening expectations around risk-based compliance, RMCP implementation, and beneficial ownership transparency, there’s never been a more important time to ask whether your controls are truly fit for purpose, or are you just ticking boxes?

FICA Requirements During Onboarding

FICA was implemented to combat financial crimes such as money laundering, terrorist financing, and fraud. At its core, FICA onboarding is about verifying the identity of clients to ensure that accountable institutions only engage with legitimate individuals or entities.

Under FICA, accountable institutions must perform Customer Due Diligence (CDD) during onboarding.

This refers to the process of establishing the identities of all prospective clients by collecting and analysing specific information to truly know your client and ultimately ensuring that the client is who they say they are.

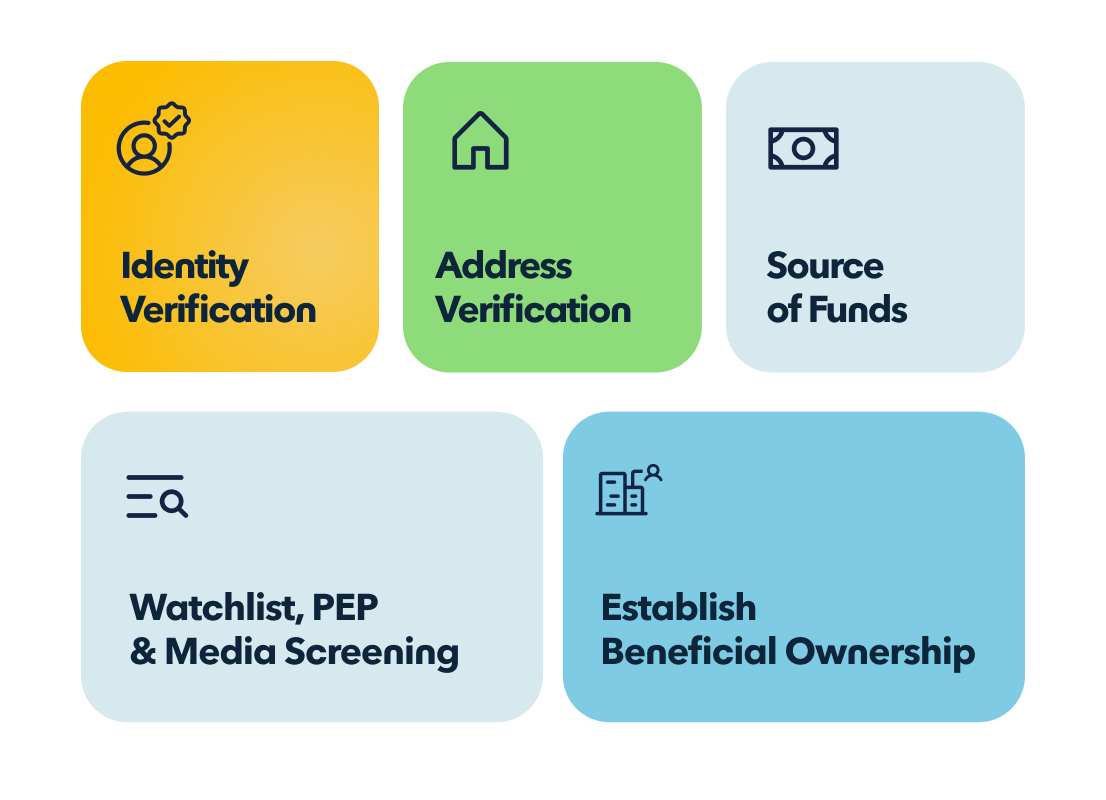

To adequately perform due diligence, you will need to collect and evaluate specific information from multiple sources. This goes beyond simply reviewing documents, it also involves, among other things:

- Verifying the identity of an individual or the registration of a legal person and their address or location

- Obtaining information regarding the economic sector or occupation of your client

- Obtaining information regarding the source of funds, nature and purpose of your client’s relationship with you

Collecting and verifying this information might sound routine, but it's at this critical juncture, during the onboarding process, that fraud often takes root.

How Fraud Intersects With FICA Onboarding

Fraudsters will often exploit onboarding processes by using false identities, forged documents, or stolen credentials. Weaknesses in CDD processes open the door for such fraudulent activity. Therefore, a robust FICA compliance strategy directly helps mitigate onboarding fraud through:

- Identity verification prevents fraudulent individuals from opening accounts under false pretenses.

- Document authentication reduces the risk of accepting falsified or tampered documents.

- Risk profiling includes the flagging of high-risk AML risk indicators to identify individuals who may need to be subjected to further scrutiny.

As criminals and technology have evolved, identity verification has become increasingly complex. Despite this, many businesses still rely on manual checks, a process with significant limitations. Our research shows that only 1 in 10 people can successfully spot a fake ID, highlighting the critical need for technology-assisted verification solutions.

FICA Compliance: Your First Line of Defence

FICA compliance is not only a legal obligation but also a frontline defence against fraud. A well-designed onboarding process which is aligned to FICA requirements ensures that only legitimate customers enter the financial system, protecting both institutions and the broader system from financial crime.

Implementing these controls manually creates bottlenecks that fraudsters exploit. Modern compliance requires technology that matches the speed and sophistication of financial crime.

By using a solution like nCino KYC you can speed up your onboarding while still ensuring irrefutable proof of customer identity. Our seamless digital onboarding enables real-time client verification, making it simple and easy to collect and verify facial data, client identification, and required documents. Reach out to our team to learn more about FICA Onboarding with Biometric Authentication and Verification.

About the author:

Mahluleli Mathiya | Principal Financial Crime Compliance Officer, nCino KYC

Mahluleli is a highly experienced financial crime compliance professional with over a decade of expertise in AML, CTF, forensic investigations, and regulatory compliance. He currently serves as Principal Financial Crime Compliance Officer at nCino KYC Africa, where he advises and supports accountable institutions on meeting the requirements of South Africa’s FIC Act. His career includes key roles at Ernst & Young, DocFox, and Investec Bank, where he led AML/CTF initiatives, risk-based compliance strategies, and forensic investigations.