What a year 2025 has been for South Africa. We witnessed significant progress in the fight against corruption, with billions of rands recovered from state capture cases. Our government has worked tirelessly to restore South Africa's reputation on the global stage, particularly in its efforts to exit the Financial Action Task Force (FATF) grey list. We've celebrated victories, confronted setbacks, and continued the hard work of building a better South Africa.

Let's journey through the defining moments of 2025, the stories that shaped our national conversation, and the turning points that may well influence our future for years to come.

Big News: Money Laundering and Terrorist Financing Crimes

The Village Deep Sweatshop Case

Seven Chinese nationals were convicted of 158 charges linked to a sweatshop they were running out of the Johannesburg CBD and sentenced to 20 years behind bars.

A raid of the Village Deep premises of their company, Beautiful City, uncovered 91 undocumented Malawian nationals living and working in shocking conditions. Over and above the human trafficking charges, they were convicted of debt bondage and contravening the country's labour and immigration laws. Read more here.

The Joshlin Smith Case

Another case that rocked South Africa was that of Joshlin Smith. Racquel Smith, also known as Kelly Smith, was convicted of a life sentence for kidnapping and human trafficking her daughter, Joshlin Smith. The 35-year-old mother of three was convicted and sentenced along with her boyfriend and their friend. The National Prosecuting Authority (NPA) welcomed the sentence and lauded the work of its team in proving that Joshlin was "sold and delivered to the intended buyer" for “exploitation, namely slavery or practices similar to slavery."

Why These Cases Matter

Human trafficking is a global issue and one of the fastest-growing crimes, along with drugs and arms trafficking. This highly profitable business generates an estimated $150 billion in profits each year.

Millions are trapped in modern-day slavery, with forced labour and sexual exploitation being the most common forms. Most victims of cross-border trafficking come from Africa, especially sub-Saharan Africa, and from South and East Asia.

Human trafficking is not only a grave human rights violation, but when proceeds from these crimes enter financial systems, it further entrenches and facilitates the crime.

The convictions in the cases mentioned, the Village Deep premises, and Joshlin Smith are major wins against crimes that have caused devastating harm to countless victims.

The Tembisa Hospital Fraud

The Special Investigating Unit (SIU) has uncovered R2 billion of stolen money from Tembisa Hospital.

The money was intended for the provision of healthcare to the most vulnerable but instead was "ruthlessly siphoned off through a complex web of fraud and corruption, representing an egregious betrayal of the nation's trust," according to SIU head Andy Mothibi.

Key officials from the Gauteng Department of Health and the hospital are accused of benefitting from corrupt payments that facilitated the irregular appointment of service providers, involving money laundering and fraud through fronting and the use of false Supply Chain Management documentation. The total value of corrupt payments linked to officials amounted to just over R122 million.

What the Tembisa Hospital Scandal Taught Us

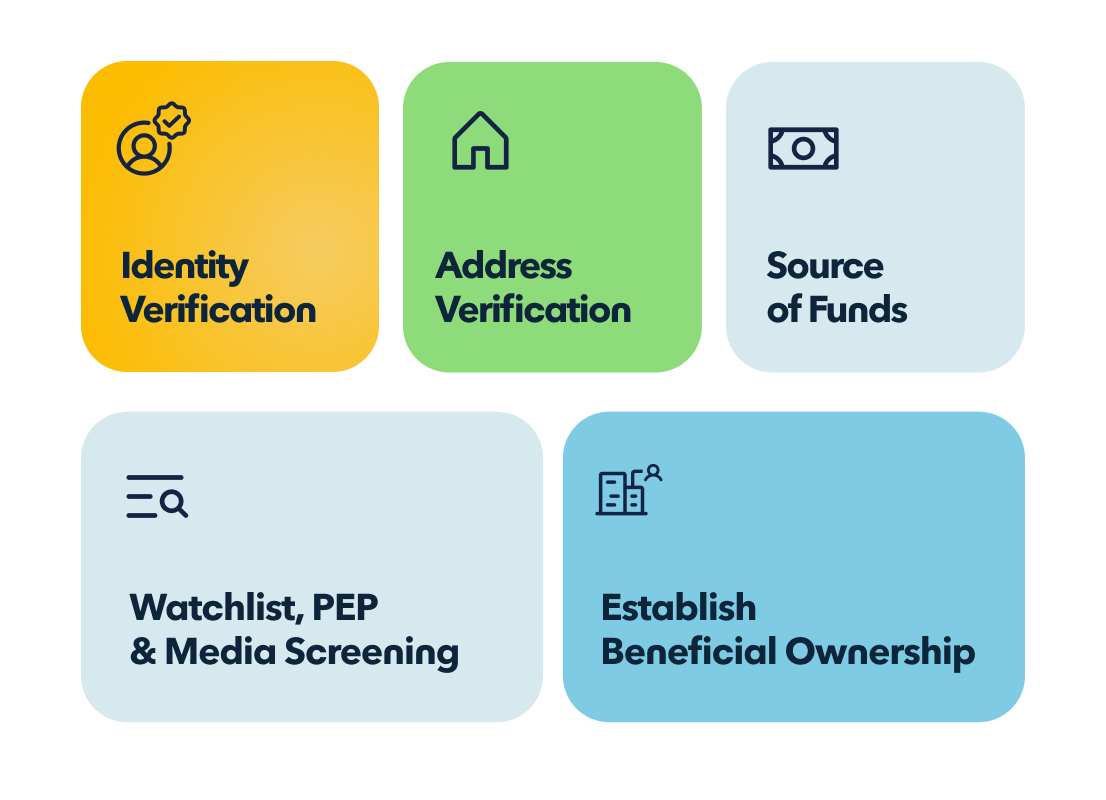

Beyond stirring outrage, this underscores why robust Customer Due Diligence (CDD) and transaction monitoring are critical. Accountable institutions must track where money originates and where it flows.

Questions Every Institution Must Ask:

- When a juristic person is transacting with you, have you established who your Ultimate Beneficial Owners (UBOs) and related parties are, have you risk rated them?

- Did you look at the adverse media hits returned to you?

- Were any of these adverse media hits used toward relevant reporting to the FIC?

Every step in the Customer Due Diligence process matters, as seen with the Tembisa Hospital case.

FIC Updates

The Financial Intelligence Centre 's (FIC) efforts to deepen its operational partnerships such as the Reformed Fusion Centre, the Asset Recovery Hub and the South African Anti-Money Laundering Integrated Task Force have enabled it to more effectively deliver on its mandate.

View more learning from the FIC 2024/2025 Annual Report.

2025 Biggest Fines: The Cost of Non-Compliance

As part of its compliance obligations under the FIC Act, all accountable institutions are required to develop and implement a Risk Management and Compliance Programme (RMCP).

Earlier this year the FIC called for accountable institutions to submit a copy of their RMCPs by 12 March. The major risk for accountable institutions that did not submit by the deadline is that it will constitute an act of non-compliance, which may invite an audit from the FIC and possible penalties and sanctions. Not having an RMCP that is fully aligned with the legal requirements will also constitute non-compliance with the FIC Act.

Why the urgency? A review of this year's largest regulatory fines shows that most FICA and FSCA penalties stem from failures to create and implement effective RMCPs. Let’s look at some of the biggest fines.

Standard Bank: R13 Million Penalty

Banking giant Standard Bank was hit with a R13 million penalty by the South African Reserve Bank (SARB) due to non-compliance with certain provisions of the FIC Act.

The instances of non-compliance included:

- Failed to conduct ongoing due diligence in respect of two of its clients, with no due diligence reviews undertaken in 2018 and 2019

- Did not keep a record of the dates on which 43 suspicious and unusual transaction reports and unusual activity reports were submitted to the FIC

- Did not timeously report 1,466 cash transaction reports and/or cash aggregation reports to the FIC, nor did they report 17,259 suspicious transactions and unusual activity incidences

- Did not timeously attend to 75,729 automated transaction monitoring system alerts within 48 hours

- Took longer than the 15-day reporting period for 94,558 suspicious transactions and unusual activity

Sanlam Collective Investments: R10.6 Million Fine

The FSCA conducted an inspection at Sanlam Collective Investments in March 2024 as part of its ongoing supervisory activities under FICA and found that the company was in breach of multiple provisions:

- While Sanlam developed an RMCP, it was not effectively implemented, particularly regarding the risk rating of its clients

- Did not have processes in place for enhanced due diligence on partnerships

- Failures in examining complex or unusually large transactions, termination of business relationships, and identification and reporting of reportable transactions

- Failures in the identification and verification of clients and beneficial owners

- Didn't conduct ongoing customer due diligence, or take steps and consider filing a report if no customer due diligence can be conducted fully

- Enhanced customer due diligence on politically exposed persons who are deemed to be high risk was not carried out

The FSCA agreed to suspend R3.6 million of the R10.6 million penalty for two years, conditional upon full remediation and sustained compliance with the relevant provisions of FICA during the suspension period.

Access Forex: SARB Administrative Sanctions

In the same week as the Sanlam Collective Investments fine, the SARB imposed administrative sanctions on Zimbabwe-based Access Forex, an Authorised Dealer in foreign exchange with limited authority (ADLA). Based in Harare, Access Forex deals with the movement of money from South Africa, the UK and Zimbabwe.

The SARB said that the administrative sanctions were imposed because of specific weaknesses that were detected in Access Forex's control measures. It also failed to reflect essential provisions of the FIC Act in its RMCP. The company also failed to verify and identify some of its customers and provide adequate training for its staff members.

2025 FIC Guidance Notes & Public Compliance Communication

The FIC issued several new Guidance Notes (GNs) and Public Compliance Communications (PCCs) this year, providing guidance on various compliance obligations under the FIC Act. Visit the FIC’s website to download the relevant documents.

- Directive 3A: Notification to the FIC of failure to report

- PCC 50A: Guidance to reporters on the measures required for the mitigation of lost intelligence data due to reporting failures, which includes the remediation and prevention of reporting failures.

- Draft PCC 118A: Consultation on the money & value transfer service provider's sector

- Guidance Note 7A: Replaces guidance note 7 that included an update to Chapter 4.

- Draft PCC 23A: The interpretation of Credit Providers

- Directive 9: Information to be submitted as part of transactions involving CASPs

- PCC 59: Guidance on beneficial ownership. Download our guide to identifying Ultimate Beneficial Owners here.

A Year of Challenge & Opportunity

Reflecting on South Africa's journey through 2025, this year has brought both challenges and opportunities for our nation. We have seen significant developments in the regulatory landscape, economic policy, and compliance requirements, all of which have reshaped how businesses operate.

Proactive compliance, robust risk management, and strategic adaptation will continue to be critical success factors for organisations navigating South Africa's dynamic compliance landscape in 2026.

.png)

About the author:

Thilomi Govender

Thilomi is a highly qualified Compliance Officer at nCino KYC with extensive experience in corporate governance and financial crime compliance. She holds an Honours in Compliance Management and is also a Certified Global Sanctions Specialist Candidate. With 9 years of experience in financial crime compliance in the financial sector, Thilomi has a wealth of knowledge in Transactional Monitoring, Customer Due Diligence, and Know Your Customer processes.