After almost three years of dedicated reform efforts, South Africa has successfully exited the FATF greylist. The international money laundering and terrorist financing watchdog, the Financial Action Task Force ("FATF"), made this announcement on 24 October 2025, following the conclusion of the FATF Plenary, which took place from 22 to 24 October in France.

Why South Africa Was Greylisted in 2023

South Africa's greylisting journey began with the FATF's October 2019 Mutual Evaluation, which identified major deficiencies in the country’s ability to combat money laundering and terrorist financing, including inadequate oversight, weak prosecution of financial crimes, and a lack of beneficial ownership transparency. Despite passing the General Laws (Anti-Money Laundering and Combating Terrorism Financing) Amendment Act in December 2022, South Africa was greylisted in February 2023 for failing to demonstrate "effective implementation" across eight key areas. Read more about the key milestones in the greylisting journey.

How South Africa Successfully Exited the FATF Greylist

In an official release, the National Treasury stated that over the last 32 months, South Africa has engaged with a team of reviewers assigned by FATF to assess progress against the action plan.

"Following the listing of South Africa on the FATF greylist in February 2023, the Government has worked tirelessly to address all the deficiencies that were identified by the FATF and which were reflected in the 22 Action Items in the Action Plan agreed between South Africa and the FATF," it noted.

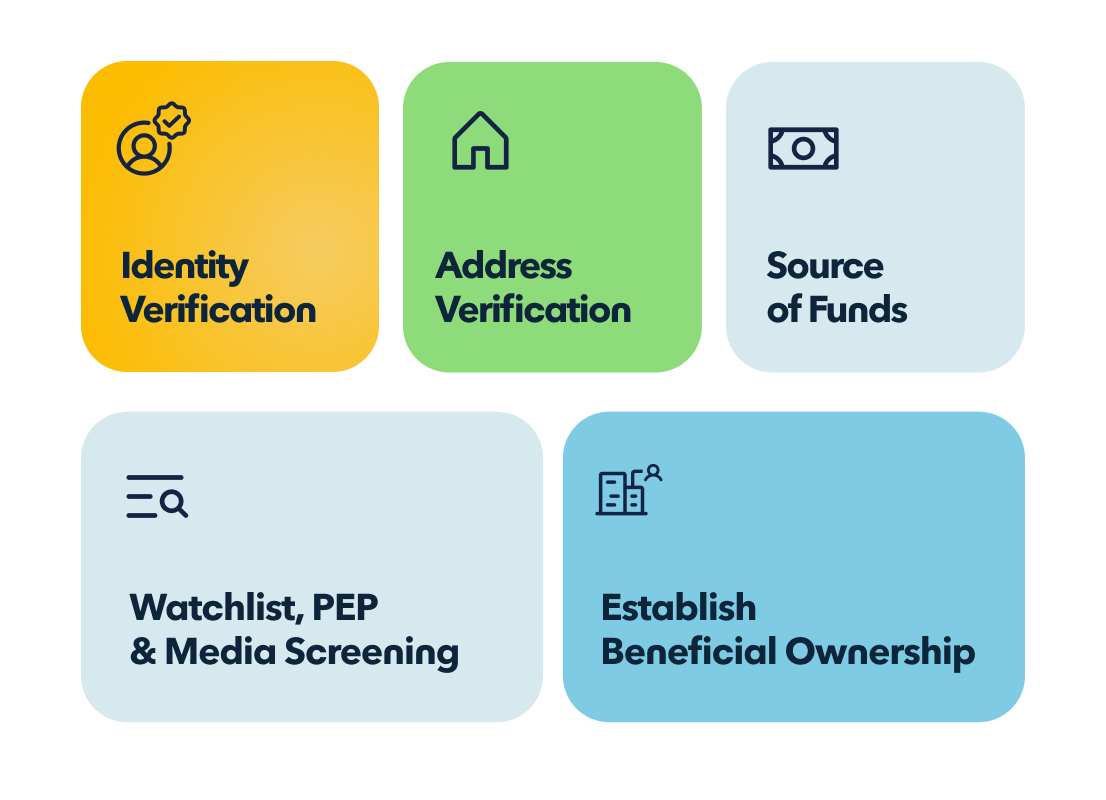

These action items covered critical areas, including:

- Demonstrating sustained increases in the investigation and prosecution of complex money laundering cases

- Increasing the effective identification, investigation, and prosecution of the full range of terror financing activities

- Addressing unlicensed cross-border money or value transfer services

- Ensuring timely access to beneficial ownership information for companies and trusts

- Implementing remedial action and dissuasive sanctions by designated AML/CFT supervisors

- Strengthening the seizure and confiscation of proceeds of crime

- Enhancing outbound mutual legal assistance requests

- Implementing a comprehensive terror financing strategy

- Ensuring the effective implementation of targeted financial sanctions

The Threat of Compliance Fatigue: SA's Biggest Risk Post-Delisting

Now that we have been removed from the greylist, the biggest risk we face over the next 12 months is "compliance fatigue". There is a real temptation to view this delisting as "mission accomplished". That would be a critical mistake. Financial crime is like a game of cat and mouse. As criminals up their game and become ever more creative in their schemes, FATF standards will continue to evolve and strengthen. This means countries need to constantly improve to keep up. Cambodia, Nicaragua, Panama, and Pakistan have been greylisted multiple times, showing that delisting isn't permanent protection against future listing. Taking FICA and compliance seriously isn't a project with an end date. It's the new normal.

What the Greylist Exit Means for South African Accountable Institutions

This wasn’t just a case where we are waiting for a mere announcement; it's a verdict on our country's resolve to combat the scourge of sophisticated financial crime. Whether removed from the list or not, the underlying issues that led us here will demand more vigilance. The bar is going to keep rising because criminals will keep innovating. If we slack off, the list will catch up to us again.

National Treasury indicated in its media release that South Africa cannot afford to stagnate after the removal from the greylist and that continued improvement is of paramount importance.

“The FATF requires countries that have exited the greylist to demonstrate continued commitment through measurable outcomes, including successful investigations, prosecutions, and sanctions as they relate to AML/CFT. To prevent being placed back on the greylist, systems of monitoring and enforcement must work more efficiently, to ensure that there are no gaps by the time of the Mutual Evaluation.”

Accountable Institutions must now operate with the assumption that hyper-vigilance, backed by smart technology that can detect red flags in real-time, is the new baseline for doing business in South Africa.

Building a Resilient Financial Ecosystem: Technology's Role in 2026 and Beyond

Fighting financial crime is a team sport. Historically, there have been challenges around our key players working together, and this was one of the key findings of the FATF that led to our greylisting. As a country, we are now working better, and we are starting to see the fruits of our labour - with collaboration that involves real-time digital information sharing between institutions, regulators, and law enforcement.

Technology is also moving beyond just number crunching and reporting of historical data to proactively identifying emerging threats. Advanced analytics and machine learning will help us spot new typologies before they become entrenched criminal methodologies, and this can lead to more adaptive regulations that evolve as quickly as criminal innovations. Traditional rule-based systems are too slow; we need principle-based approaches that allow institutions to innovate while maintaining strong controls.

Technology's role will be central to the future of effective compliance, but the most sophisticated RegTech solution fails without proper governance, skilled personnel, and institutional commitment. Technology amplifies human expertise; it doesn't replace the judgment and ethical foundation that effective compliance requires.

The institutions that will thrive in 2026 and beyond will be those that view compliance as an investment, not as a cost: a competitive advantage that enables them to onboard customers faster, serve markets more confidently, and operate with the transparency that modern stakeholders demand.

If you haven't already, sign up to our Newsletter to keep updated with the latest FICA compliance / Anti-Money Laundering and Greylisting news.