As automotive businesses plan for the year ahead, the regulatory landscape has never been more demanding – or more consequential. Hawken McEwan, Director of Risk and Compliance at nCino KYC, explains why compliance is really about protecting your business, your reputation, and your future.

For South Africa's automotive sector, 2026 arrives with a stark reality check: compliance is no longer optional, and the consequences of getting it wrong have never been more severe.

Most motor vehicle dealerships now find themselves under the same stringent compliance obligations as banks and financial institutions, as they're classified as "high-value goods dealers" under the Financial Intelligence Centre Act (FICA). It's a designation that applies to any business selling a single physical item for R100,000 or more.

For an industry accustomed to operating with relative regulatory freedom, the shift has been seismic, with the pressure only going to intensify.

The Grey Listing Effect

South Africa's placement on the Financial Action Task Force (FATF) grey list has fundamentally changed the compliance landscape. The FATF identified the non-financial sector – including high-value goods dealers, attorneys, and estate agents – as one of the biggest risks for financial crime in the country.

The pressure on these industries to pick up and get compliant with FICA is relentless, and it will not lighten up even after South Africa's recent exit from the greylist.

The consequences are already being felt. A financial penalty of over R6million was imposed on LSM Distributors (Pty). Other businesses have been hit with fines starting at R10,000 for failing to complete a simple online form requested by the Financial Intelligence Centre (FIC).

The reality is simple: it is much cheaper to be compliant than to pay a potential fine.

With the FATF scheduled to return in 2026 for South Africa's next review, enforcement is set to remain aggressive. The regulator needs to demonstrate "consistent enforcement" to avoid the country slipping back onto the grey list – a scenario that would have devastating economic consequences.

Four Critical Areas to Address Now

At nCino KYC, we're seeing automotive businesses fall short in four key areas that need immediate attention:

- Risk Management and Compliance Programmes (RMCP)

Every accountable institution must have a comprehensive RMCP document that acknowledges their FICA obligations, includes a full risk assessment of the business, and explains how identified risks will be mitigated.

Too many companies either don't have this document, or their document isn't comprehensive enough. We've seen RMCPs that are just three or four pages long.

- Due Diligence on Legal Entities

Whilst most businesses are comfortable collecting ID documents from individual customers, they struggle with corporate clients.

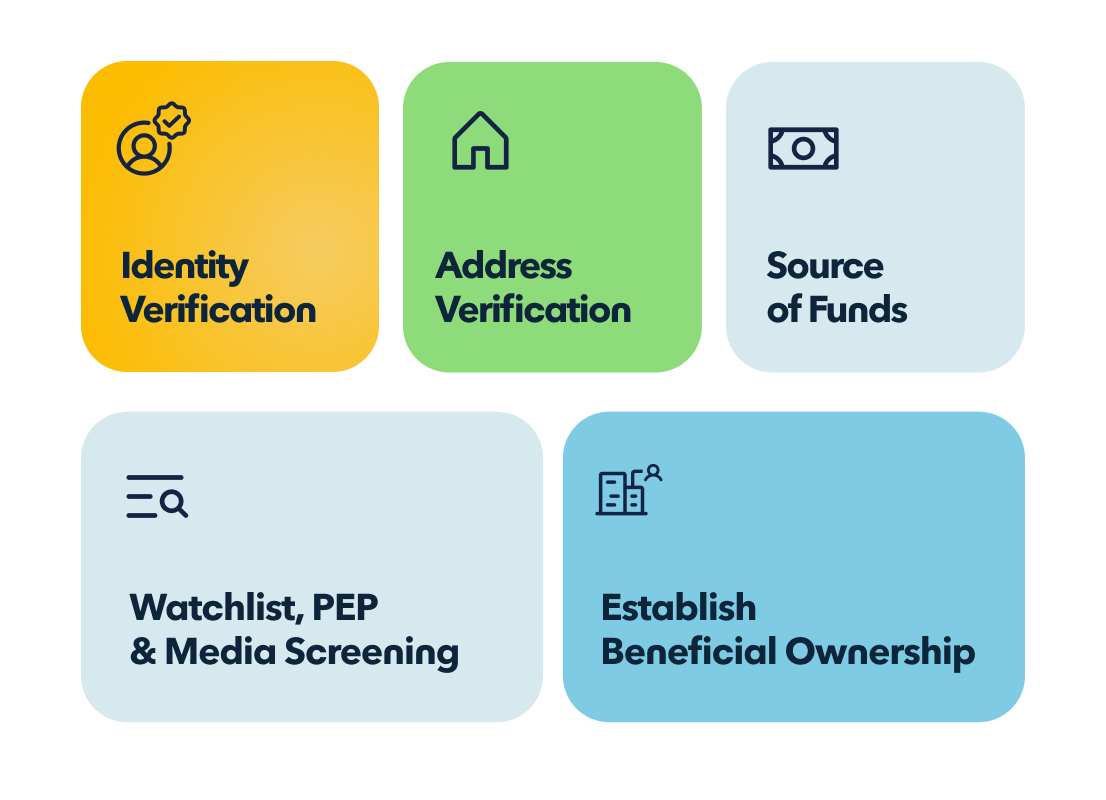

FICA requires dealerships to identify all directors of a company, as well as the ultimate beneficial owners – anyone holding 5% or more of the shareholding. If one of those entities is a trust or partnership, businesses must dig deeper to find the actual people behind it.

- Sanctions Screening

Every customer must be screened against the targeted financial sanctions list before being accepted, and then re-screened every time that list changes – which can be every few days. For a business with 100 to 200 customers, manual screening is virtually impossible.

- Reporting Cash Transactions

The automotive sector has historically been cash-heavy, with dealerships known to accept large sums without asking questions. Under FICA, any cash transaction of R50,000 or more must be reported to the FIC. Many businesses have been fined for failing to do so.

From Burden to Competitive Advantage

Compliance is universally seen as a "regretted cost" – an expense that doesn't generate revenue. But the mindset is beginning to shift, driven primarily by enforcement.

While we'd love to say that ethically and morally the world has changed, the reality is different. What dealers are seeing is that these fines are great enough to justify letting that sale of a Mercedes go, because they don't want a half-a-million-rand fine.

Beyond avoiding penalties, there's a reputational dimension as well, with financial institutions and other partners increasingly reluctant to do business with non-compliant organisations.

In a competitive market, demonstrating robust compliance can become a differentiator. It is a signal to customers, partners, and regulators that a business is trustworthy and professionally run.

Technology as an Enabler

For businesses overwhelmed by compliance requirements, technology offers a practical solution.

Platforms like nCino KYC automate time-consuming tasks: verifying customer information against Home Affairs and CIPC databases, conducting sanctions screening, flagging red flags, and maintaining audit trails.

Using world-class technology, our advanced liveness testing not only confirms the presence of a live individual but also verifies their identity by cross-referencing captured data with the Department of Home Affairs – in real-time.

Beyond software, nCino KYC also offers compliance services, meaning crucial support is provided for industries new to full FICA obligations. Many businesses don't have big compliance teams and they're not quite sure where to even start. That's where our qualified and experienced compliance team comes in.

The Bottom Line

Our advice for automotive businesses entering 2026 is unequivocal: you should already be compliant. If you're not, hurry up, because the FIC are watching.

There are no excuses: High-value goods dealers have been accountable institutions for two to three years now, and the regulator is no longer accepting delays or justifications.

For businesses that have been putting off compliance, hoping the issue would fade, the message is clear: the time to act is now. The cost of non-compliance – financial, legal, and reputational – far outweighs the investment required to get it right. If you don't know what to do, ask for help, but get compliant.

In 2026, staying afloat means maintaining your compliance, protecting your business, and ensuring you're still in the race when others have been forced off the track.

For more information about nCino KYC and to find out how it can ensure your business is fully compliant, reach out to our team.

About the author:

Hawken McEwan

Hawken has over 25 years' experience in financial crime compliance, regulatory operations, banking operations, risk and change. Specialising in FICA and Anti-Money Laundering, Hawken is an FSCA approved Compliance Officer, FAIS Key Individual and an advisor to BankSETA around AML due diligence and transaction monitoring. He holds a Masters from the University of Edinburgh, a PGCE from the University of Sunderland and is a certified Anti-Money Laundering Specialist.