With the Financial Action Task Force (FATF) set to announce its decision on South Africa’s greylisting status in the coming weeks, the nation’s economy and international standing hang in the balance. We have compiled a timeline of key events and expert commentary to provide critical context on the journey to this verdict and the high stakes involved.

This isn’t a case where we are waiting for a mere announcement; it's going to be a verdict on our country's resolve to combat the scourge of sophisticated financial crime. Whether we are removed from the list or not, the underlying issues that led us here will demand more and more vigilance. The bar is going to keep rising because criminals will keep innovating. If we slack off, the list will catch up to us again.

The economic impact: What’s at stake

Since being greylisted, South Africa has faced dramatically increased costs of doing business internationally, reduced foreign investment, and significant reputational damage. Analysis by National Treasury and various economists has consistently pointed to the detrimental effect on already low GDP growth and capital flows, with the ultimate cost running into billions of Rands.

A 2023 report by research firm Intellidex estimated that the ultimate cost could be a contraction of South Africa's GDP by up to 3% over the long term, eroding capital inflows and increasing the cost of capital for all.

Key milestones in the greylisting journey

- October 2019: The warning shot

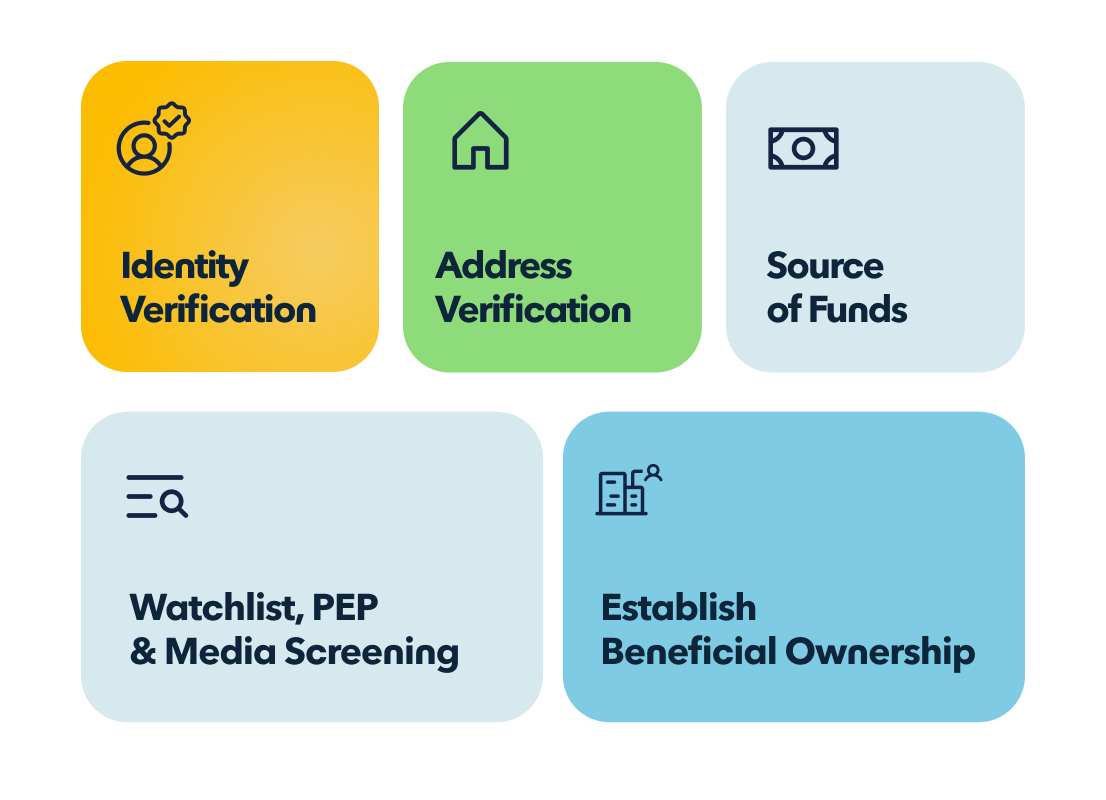

The FATF’s Mutual Evaluation of South Africa identified major deficiencies in the country's ability to combat money laundering and terrorist related financing. The report highlighted a lack of effective oversight by supervising bodies, inadequate investigation and prosecution of financial-related crimes, a weak framework to deal with terrorism related threats, and the lack of information around corporate transparency and beneficial ownership. - December 2022: The legislative scramble

In an effort to avoid greylisting, Parliament passed the General Laws (Anti-Money Laundering and Combating Terrorism Financing) Amendment Act. The act aimed to address some of the FATF's technical concerns by broadening the scope of Accountable institutions, bringing proliferation financing into scope and introducing requirements for beneficial ownership registers. - February 2023: Greylisting confirmed

Despite the legislative efforts, the FATF placed South Africa on its list of jurisdictions under increased monitoring. The core issue remained a failure to demonstrate "effective implementation" across eight key areas of concern. - October 2025: The verdict awaits

After almost 3 years on the list, the FATF is set to announce its decision. The outcome will likely feature prominently in discussions around the Medium-Term Budget Policy Statement (MTBPS) tabled in November. - 24 October 2025: South Africa Exits the FATF Greylist!

The FATF’s required action plan

The FATF’s core demands centred on proving the system works in practice. Key requirements included:

- Effective use of financial intelligence by law enforcement to support investigations.

- A dramatic increase in the investigation and prosecution of serious money laundering and terrorist financing cases.

- The establishment of a beneficial ownership registers to stop criminals from hiding behind complex legal structures.

- Strengthened risk-based supervision of accountable institutions.

Regardless of the outcome in October, the pressure, whether on the country as a whole, or on the people working at accountable institutions from car dealerships to real estate agencies, is not going to ease.

Accountable institutions must now operate with the assumption that hyper-vigilance, backed by smart technology that can detect red flags in real-time, is the new baseline for doing business in South Africa.

After almost three years of dedicated reform efforts, South Africa successfully exited the FATF greylist on 24 October 2025. Read more about what this means for accountable institutions.

If you haven't already, sign up to our Newsletter to keep updated with the latest FICA compliance / Anti-Money Laundering and Greylisting news.

About the author:

Hawken McEwan

Hawken has over 25 years' experience in financial crime compliance, regulatory operations, banking operations, risk and change. Specialising in FICA and Anti-Money Laundering, Hawken is an FSCA approved Compliance Officer, FAIS Key Individual and an advisor to BankSETA around AML due diligence and transaction monitoring. He holds a Masters from the University of Edinburgh, a PGCE from the University of Sunderland and is a certified Anti-Money Laundering Specialist.