“Financial crime has become increasingly sophisticated, and for small to medium-sized businesses that may not be able to build their own systems, it is prudent to partner with and outsource the services of experts like nCino KYC, that can ease your compliance and application fraud concerns while you focus on your day-to-day business.” - Kevin Hogan

The Fraud and Money Laundering Webinar hosted by nCino KYC in September 2025 offered practical insights into the intersection of fraud prevention, financial crime compliance, and regulatory obligations under the Financial Intelligence Centre Act (FICA).

With fraud and financial crime risks on the rise, sessions like this highlight the critical need for continued dialogue, knowledge sharing, and collaboration across the financial services sector. The discussion emphasised the growing urgency of addressing fraud and compliance risks in a rapidly evolving financial services landscape, highlighting how technology and risk management practices are critical in protecting both institutions and their clients.

Expert Perspectives: Real-World Insights on Compliance and Fraud Risk

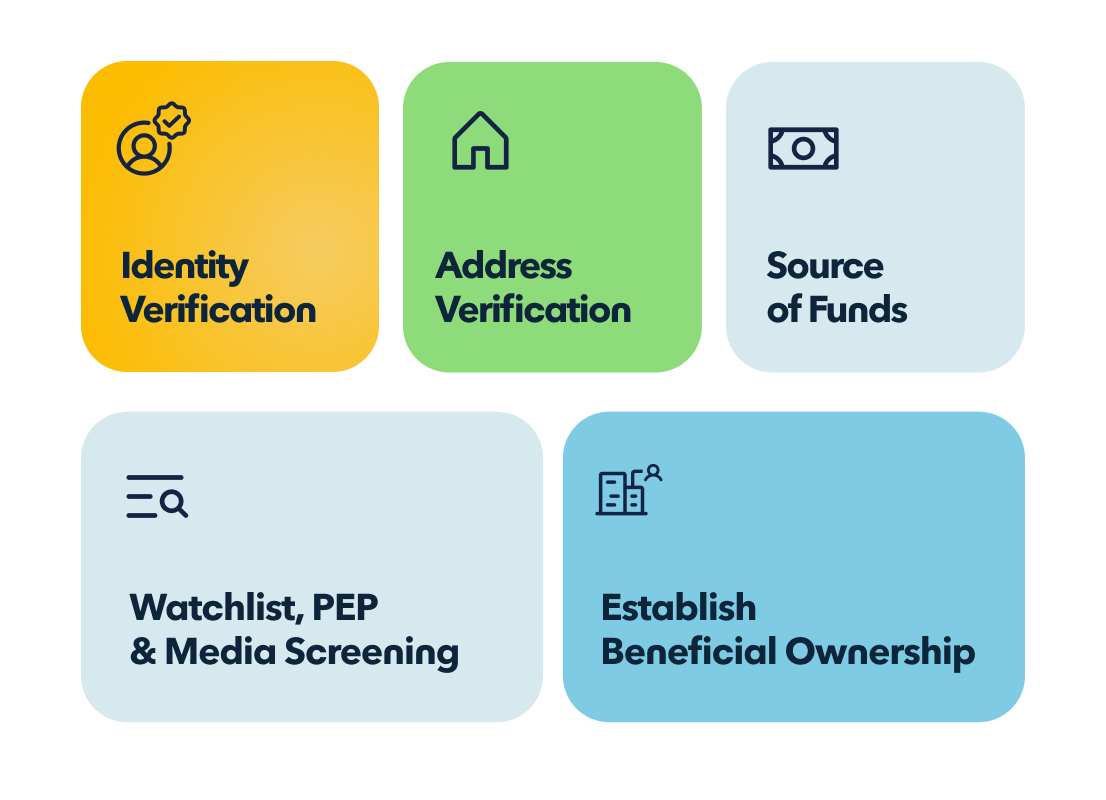

Mahluleli Mathiya, Principal Financial Crime Compliance Officer at nCino KYC Africa, shared expert commentary on how FICA obligations are being reshaped by global compliance trends, especially in areas such as beneficial ownership transparency, Politically Exposed Persons (PEP) screening, and ongoing transaction monitoring.

He stressed the importance of adopting a risk-based approach and outlined practical steps accountable institutions can take to strengthen their Risk Management and Compliance Programmes (RMCPs). He also highlighted that a robust FICA compliance framework is not only a regulatory requirement but also an effective fraud mitigation tool, stating: “Weaknesses in FICA onboarding and client due diligence processes are an invitation to fraudsters who exploit them by use of forged documents, false identities, and stolen credentials.”

Kevin Hogan, Head of Fraud Risk at Investec Bank Ltd, delivered a powerful session on the latest fraud typologies impacting South African businesses. Drawing from real-world cases, Hogan explored identity theft, synthetic identities, advance-fee scams, and digital channel vulnerabilities. He also discussed how fraud and financial crime are increasingly interconnected, underscoring the need for integrated prevention strategies.

He concluded by sharing tips on how to identify indicators of forgery and tampering on the South African green ID book. Hogan went on to address the importance of secure and complex pins and passwords. “Most people’s phones can be hacked in under a minute because of weak passwords, when creating passwords, settle for phrases and sentences that you will remember, as opposed to dates of births and names of family members. The use of password creation and storage apps is also encouraged as well as multiple-factor authentication methods on sensitive apps and gadgets.”

Fake IDs: Why 9/ 10 People Fail to Spot Them

Over the years the South African green barcoded ID book has undergone several design changes, particularly in fonts and layout, to enhance security. While experts like Kevin can spot a fraudulent ID in an instant, most people are unaware of these subtle updates and may not be able to distinguish a fraudulent ID from a real one. Read more about reliable methods to detect fraudulent IDs.

Key Takeaways: Staying Ahead in the Fight Against Fraud and Financial Crime

Some of the strongest themes to emerge from the webinar included:

- The growing sophistication of fraudsters and the necessity for agile fraud detection frameworks.

- The critical role of FICA compliance in building a resilient financial system.

- The benefits of leveraging technology-driven solutions, such as Biometric Authentication and Verification, and continuous screening, to stay ahead of evolving threats.

- The importance of collaboration between financial institutions, regulators, and technology providers to combat fraud effectively.

Stopping Fraud at the Gate: nCino KYC’s Biometric Authentication & Verification

As highlighted during the session, bad actors exploit weak onboarding processes and perpetrate fraud. As criminals grow more sophisticated, businesses must stay vigilant and strengthen their verification measures. That’s where nCino KYC’s Biometric Authentication and Verification comes in. This secure, three-step process ensures the individual undergoing verification is alive and that the selfie captured matches their identity documentation and the record at Home Affairs. Request a demo to see this feature in action.